Research

Job Market Paper

Debt Callability and Firm Dynamics.

PDF

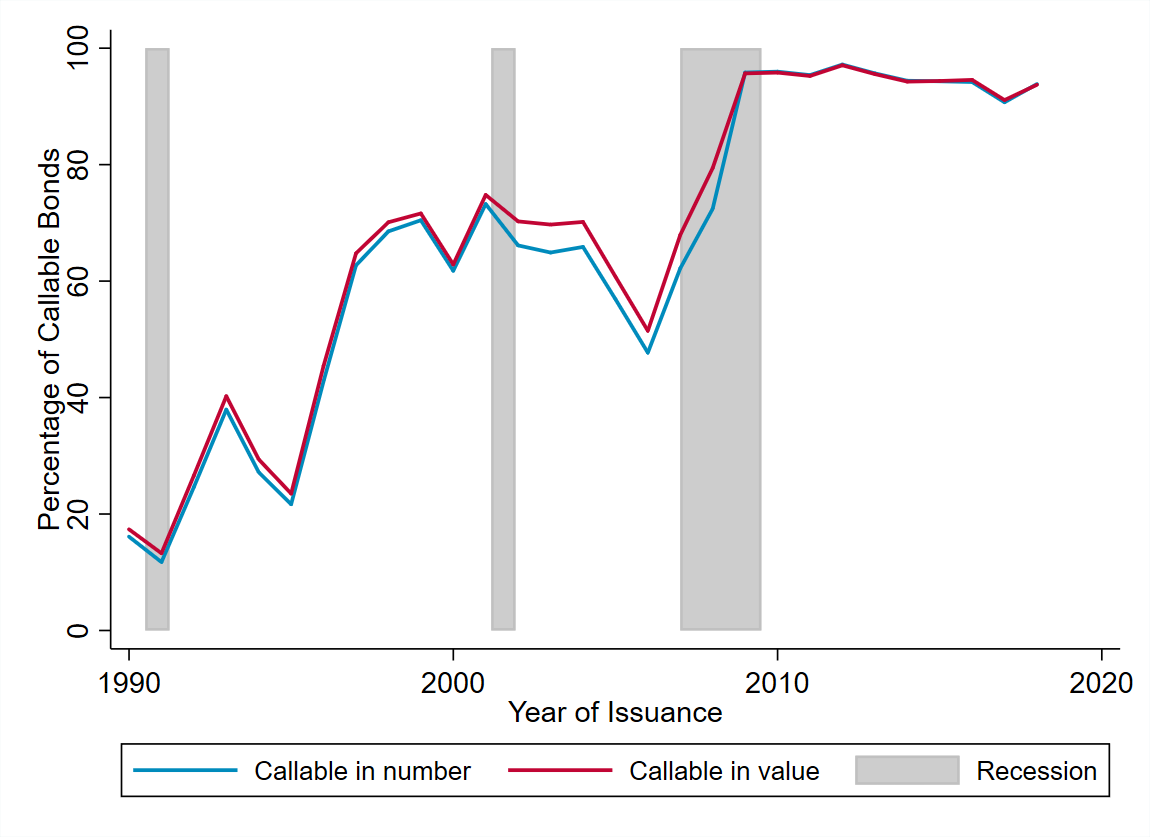

Callable debt - a bond allowing issuers to redeem outstanding principal before maturity - has become dominant in U.S. corporate bond markets since the Global Financial Crisis. This paper examines the relationship between callability and firm investment, as well as its macroeconomic implications. Using an issuer–bond panel, I document a gap between contract design and effective eligibility: while 59% of outstanding debt is contractually callable, only about 1.7% is callable at the beginning of a typical quarter due to lock-out provisions; conditional on eligibility, firms call about 3.5% of eligible debt per quarter. Firms with weaker credit quality tend to rely more on callable issuance but exercise the calls less frequently. Exploiting high-frequency monetary policy surprises in a local-projection framework, I find that callable debts amplify investment responses only when firms actually call, with the strongest effects for firms holding larger eligible callable shares. To interpret these facts, I develop a heterogeneous-firm model with long-term non-callable and callable debts, endogenous default and call decisions, and investment. The model quantitatively replicates the cross-sectional incidence of contractual versus effective callability, the conditional call hazard, and the investment behavior. Callability increases the rate sensitivity of investment by about 21% relative to a baseline without callable debt, highlighting how debt callability in firms' financing structures influences aggregate investment dynamics.

Conferences and Seminars: Bank of Canada Graduate Student Paper Award Workshop (2025), IFC (2025), Wilfrid Laurier U. (2025), University of Montreal, 2024 Annual Meeting CEA, Federal Reserve Bank of St. Louis, 2023 Annual Meeting CEA, 2023 CEA Graduate Poster Session, 2022 SCSE, 2022 17th CIREQ Ph.D. Students Conference, Quebec Social Sciences Ph.D. Students Seminar.

Selected Work in Progress

1. Seniority Structure in Macroeconomics, with A. Ekponon (UOttawa) and H. Somé (USherbrooke).

Seniority in debt contracts refers to the order of repayment in the event of a firm's default, where senior debt holders are paid before junior creditors. The seniority hierarchy in debt contracts is increasingly relevant in firm financing, yet its aggregate effects are largely understudied. This paper investigates the macroeconomic implications of introducing a seniority structure in firm debt within a dynamic business cycle model with defaultable long-term debt. We show that a seniority structure is crucial in mitigating the debt dilution problem, which arises when firms issue new debt that reduces the value of existing claims, particularly in long-term debt markets. By prioritizing senior claims in the event of default, firms can protect senior debt holders from dilution, resulting in more efficient credit allocation. Our model demonstrates that seniority structure reduces risk premia on senior bonds, lowers firm leverage, and induces more stable investment patterns. Additionally, we provide empirical evidence using firm-level data that seniority structure is associated with lower default rates and reduced financial fragility, particularly during economic downturns. On the aggregate level, introducing seniority structure in firm debt smooths business cycle fluctuations, reduces macroeconomic volatility, and enhances financial stability.

2. Financial Frictions, Intangible Capital, and the Business Cycle.

This paper studies how the rise of intangible capital reshapes firm financing and business cycle dynamics. Using firm-level data, I document three stylized facts. First, intangible-intensive firms rely disproportionately on equity financing and face persistently higher credit spreads relative to tangible-intensive firms. Second, their investment is more sensitive to aggregate downturns, with sharper contractions during financial crises and slower recoveries thereafter. Third, the cyclicality of financing costs is amplified for intangible-heavy firms, suggesting that limited collateralizability exacerbates procyclical financing frictions. To interpret these patterns, I develop a heterogeneous-firm equilibrium model with two types of capital—tangible and intangible—that differ in pledeability. Firms choose their financing mix subject to collateral constraints, and aggregate shocks propagate through the interaction of financing frictions and capital composition. The model reproduces the empirical facts and delivers a key insight: the growing share of intangibles amplifies aggregate fluctuations by tightening financing constraints in downturns.

3. Business Cycles, Competition, and Stock Returns, with A. Ekponon (UOttawa) and H. Somé (USherbrooke).

We investigate the competition-stock returns relationship in an economy in which a firm’s stock returns depend on macroeconomic risks, industry risk, and the heterogeneity (for example, the level of competition) between industries in their exposure to macroeconomic risk. Hence, the combined effects of time-varying conditions on the industry and firms’ returns are likely to bring some important contributions to the study of the relationship between competition and stock returns. In this study, we investigate how macroeconomic conditions influence the total stock returns of firms and their respective industries over time. By incorporating industry-specific characteristics such as competition levels into our framework, we aim to understand the relationship between competition and equity returns at both the firm and industry levels.

Funding from the Telfer School of Management (SMRG 2025).

4. Monetary Policy Narratives and House Price Expectations, with F. Ayivodji (IMF).

This paper examines the impact of central bank narratives on house price expectations using a unique dataset of approximately 5 million sentences from three textual sources: direct central bank communication (including monetary policy reports and speeches), newspaper articles, and X(Twitter) posts. Leveraging advanced computational linguistics and large language models (LLMs), we analyze the narrative tone in these sources related to the Bank of Canada's monetary policy decisions. Our findings reveal that narrative sentiment significantly shapes expectations for future house prices, with sentiment related to credit, financial conditions, and housing narratives holding considerable predictive power. Using LLMs, we extract both backward-looking and forward-looking aspects of sentiment in monetary policy narratives, highlighting the pronounced impact of forward-looking sentiment on house price expectations. Additionally, we find that media coverage plays a crucial role in channeling central bank communication to the public, with variations in the effectiveness of this transmission over time. This underscores the media’s influence in shaping economic expectations, particularly during periods of heightened uncertainty. The study suggests that social and news media can serve as valuable tools for central banks in managing economic expectations, with significant implications for the housing market.

5. Inside the Non-Compete Agreements Damages in the U.S., with F. Ayivodji (IMF) and F. Goudou (Wayne State U.).

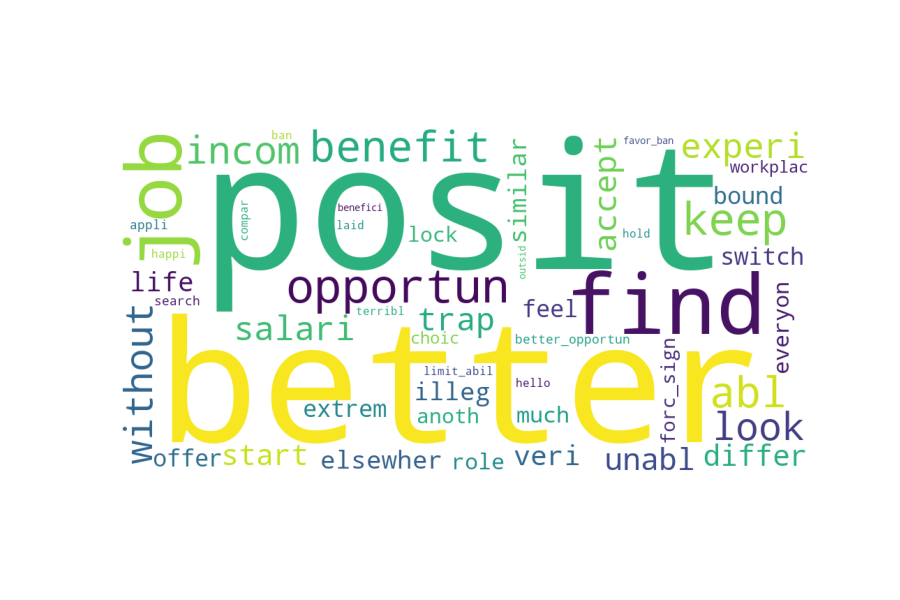

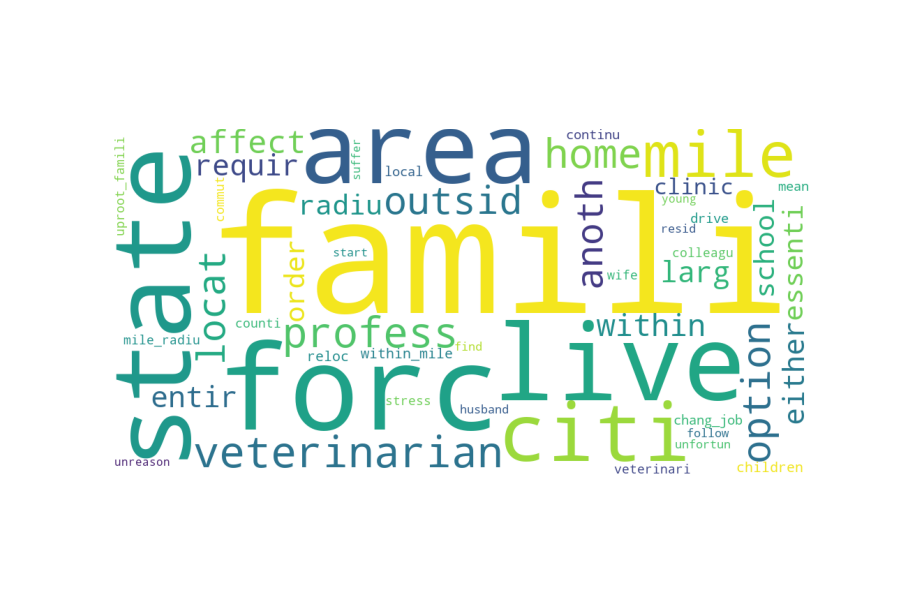

This paper investigates the economic and social repercussions of Non-Compete Agreements (NCAs) in the United States. On January 5, 2023, the Federal Trade Commission's (FTC) proposal to ban NCAs intensified public debate, making it a timely and relevant topic of study. Leveraging cutting-edge natural language processing (NLP) techniques, we analyze a large dataset of public comments submitted to the FTC and social media posts related to the proposed NCA ban to provide a comprehensive picture of how NCAs affect individuals and the economy. Our findings suggest that NCAs exacerbate mental health issues and contribute to family dislocations, reducing overall well-being. Furthermore, we document that NCAs limit worker mobility, stifle innovation, and constrain labor market competition, leading to inefficiencies in resource allocation. These negative impacts are particularly pronounced for low-wage workers and employees in highly specialized industries. The paper also provides evidence that large firms strategically use NCAs to retain high-paid talent and reinforce labor market power imbalances. In light of these findings, we argue that NCAs pose significant harm to both individuals and the broader economy and advocate for a reassessment of their role in the modern workforce. Our study contributes to the ongoing policy discussion by highlighting the nuanced and often underrepresented effects of NCAs and their implications for labor market dynamics and economic growth.

(a) New Job Opportunity

(b) Employee Mobility Restriction

(c) Health Employees

(d) Family Constraint

Publications (Before Ph.D.)

Twin Deficits : Empirical investigation for Togo.

61st World Statistics Congress Proceedings, 2017.

PDF

Abstract

This paper investigates the hypothesis of twin deficits in Togo. There is a great economic debate about the twin deficits hypothesis which indicates a positive relationship between the current account deficit and the fiscal deficit resulting from changes in tax revenues or government expenditures. The presence of this link is rarely tested for developing countries. To examine the twin deficits in Togo, I use a Vector AutoRegression (VAR) framework, based on time series from the period 1975-2015. I find a unidirectional causality from the fiscal deficit to the current account deficit and this reveals the presence of twin deficits in Togo and also conformity with the Keynesian approach (conventional view).

Policy Papers

Reformer l’Enseignement Technique et de la Formation Professionnelle pour l’Employabilite des Jeunes en Afrique

L’Afrique Des Idées, 2018

PDF

Abstract

Étreintes par le sous-emploi et le chômage des jeunes, les économies africaines devront réinventer leur système éducatif. Si le débat n’est pas nouveau, notamment en ce qui concerne le rôle de l’éducation dans la formation du capital humain, ses termes devront avancer en incluant les spécificités de la formation professionnelle. Les structures des économies et les bouleversements externes repositionnent la question de la formation pour l’emploi dans un contexte totalement rénové où le privé, l’informel, le numérique ont une nouvelle résonance. Bien entendu, le chômage des jeunes est sous tension, notamment parce que (i) un point de croissance économique ne génère que 0,4 point d’emplois en Afrique, (ii) moins de 16% des formations dans le supérieur constituent les formations dites « STEM», et (iii) seulement 15% du budget de l’éducation est consacré à la formation professionnelle. Cependant, la jeunesse la plus entreprenante du monde est en Afrique. Elle constitue 69% de la population, et ensemble avec le potentiel du numérique, offre des marges réelles de transformation de la dynamique de l’emploi en Afrique.